The long-anticipated SEC rules on climate disclosure, eagerly awaited by many including myself, have finally been published after almost two years of work.

The following are the definitive requirements for disclosure, according to SEC’s Fact Sheet:

- Climate-related risks that are considered material, i.e., those that can impact business strategy and financial performance.

- The impacts of the identified risks.

- Quantitative and qualitative descriptions of mitigation and adaptation activities, including impacts, assumptions, transition plans, costs, etc.

- Board oversight of the risks.

- Processes for identifying, assessing, and managing climate risks, as well as how they are - linked to other business risk management.

- Climate targets.

- For Large Accelerated Filers (LAFs) and non-exempt Accelerated Filers (AF): scope 1 and 2 - emissions.

- Costs and losses incurred due to severe weather conditions.

- Costs and losses related to carbon offset and renewable energy credits or certificates.

- Explanation of estimates and assumptions impacted by any of the physical or transitional climate risks.

The list implies that adherence to ISSB S2 Climate-related Disclosures under IFRS positions the corporation well to meet the SEC's climate-related disclosure rules.

Disclosure and Financial statement effects audit will start from FYB 2025 for LAFs.

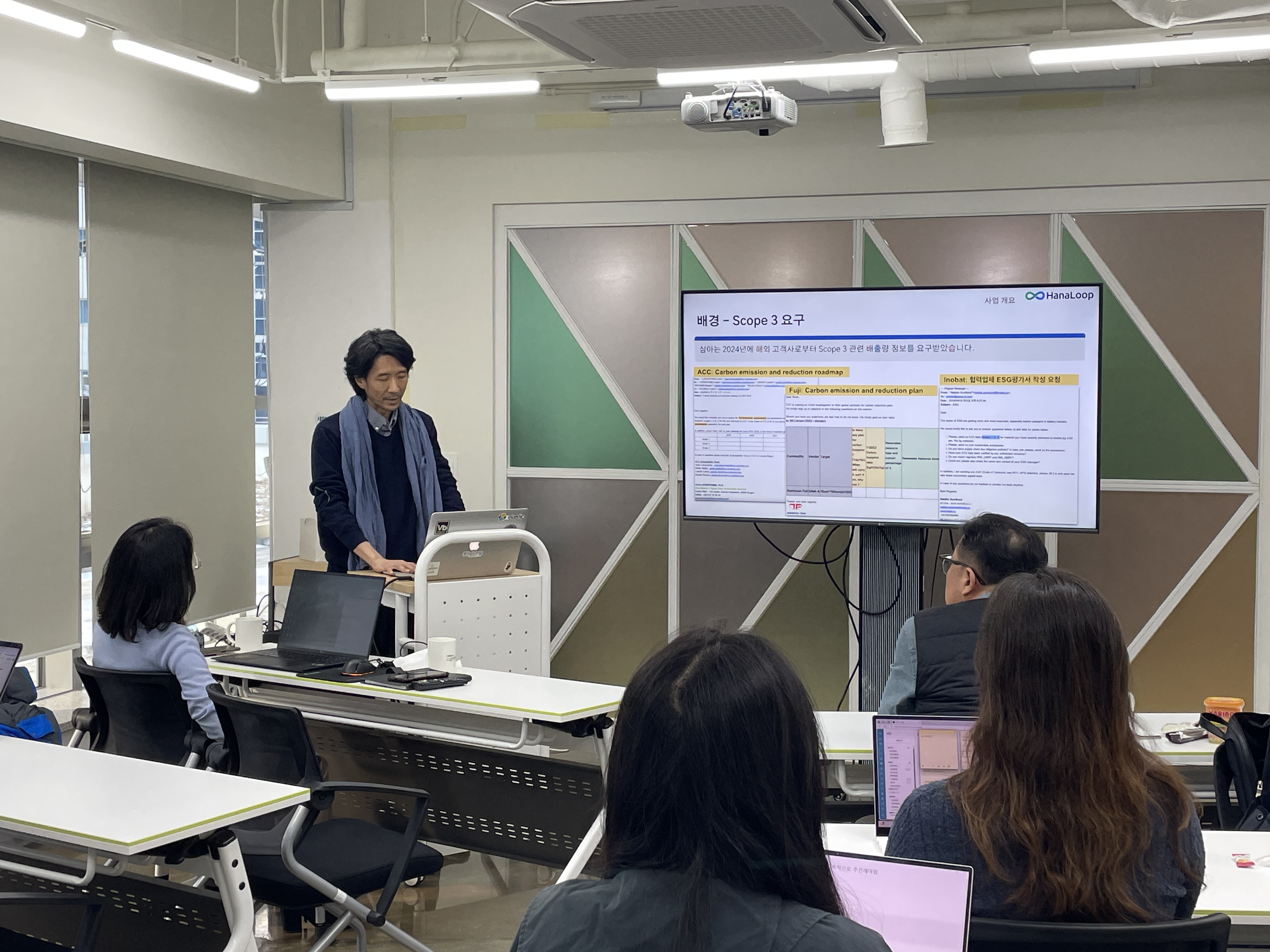

What Happened to Scope 3 Disclosure?

As suggested by numerous recent reports, the final regulation has ultimately excluded the requirements for Scope 3 emissions disclosure.

I feel relieved that the rule has finally been finalized; however, I am somewhat disappointed by the decision to exclude the requirement for disclosing Scope 3 emissions.

I will present two compelling reasons underscoring the importance of Scope 3 emissions disclosure:

Firstly, Scope 3 emissions often constitute a significant portion of a company's overall carbon footprint, exceeding 70% in various sectors. By adopting a comprehensive approach that encompasses Scope 1, 2, and 3 emissions, companies can uncover broader opportunities for reducing their environmental impact. This holistic perspective enables organizations to implement more effective and extensive emission reduction strategies.

Secondly, substantial climate-related risks are frequently obscured within Scope 3 emissions. In today's interconnected global economy, disruptions in the supply chain can have far-reaching implications for businesses. For instance, the reliance on rare minerals essential for manufacturing advanced technological equipment poses a transitional risk due to regulatory changes. Similarly, agricultural products like coffee beans, cocoa, and cotton are highly susceptible to the physical risks associated with climate change. Moreover, industries reliant on carbon-intensive materials such as steel, cement, and aluminum face significant challenges from policies like the Carbon Border Adjustment Mechanism (CBAM), which could markedly affect their supply chains. Recognizing and addressing these vulnerabilities is crucial for sustainable business practices and resilience in the face of climate change.

The requirement for reporting Scope 3 emissions was removed due to the significant challenges companies encounter in measuring these indirect emissions. Ideally, businesses would voluntarily take the initiative to control their emissions, attracting consumers who favor environmentally responsible companies. Yet, in practice, for-profit entities frequently resist investing in initiatives that, while beneficial to society, do not directly generate revenue.

However, the complexity of measuring Scope 3 emissions should not be an excuse for inactivity. Confronting these challenges can actually drive innovation, prompting companies to pioneer new markets and develop solutions that promote environmental sustainability.

Societies will increasingly face the challenges of more frequent droughts, while disruptions in global transit, such as those experienced at the Panama Canal last year, pose significant risks to supply chains. Furthermore, food supplies are vulnerable to the adverse impacts of severe climate conditions. Policy makers must anticipate these challenges and implement robust rules and regulations as a pivotal element of the mitigation strategy. This proactive approach is imperative to safeguard the social fabric and maintaining the stability within the industry.

References